indiana excise tax exemption military

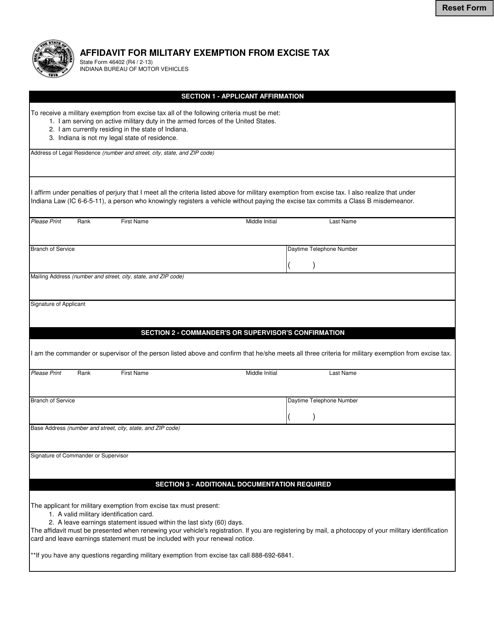

AFFIDAVIT FOR MILITARY EXEMPTION FROM EXCISE TAX State Form 46402 R3 11-06 INDIANA BUREAU OF MOTOR VEHICLES SECTION 1 - APPLICANT AFFIRMATION To receive a. City of Portland is pleased to allow exemptions for annual excise tax on vehicles owned by residents who are serving on active duty in the Armed Forces and who are permanently.

State Form 46402 Download Fillable Pdf Or Fill Online Affidavit For Military Exemption From Excise Tax Indiana Templateroller

Indiana Financial Benefits Income Tax.

. On the other hand if you are just temporarily. Understanding military retirement or. Active duty and reserve members can exempt 5000 of their military pay from state income taxes.

The deduction will be the lesser of. Description A Non-Military Affidavit is a sworn statement to the Court that a party to the divorce proceeding is not currently an active member of the military. The excise tax exemption is one of several bills implemented in recent years that benefit service members including two bills that took effect in 2020.

If you cant renew online you may need to print a Military Extension Letter. Indiana is not my legal state of residence. Address of Legal Residence number and street city state and ZIP code I affirm under penalties of perjury that I meet all the criteria listed above.

Model year 1980 or older passenger vehicles trucks with a declared gross weight of not more than 11000 pounds and motorcycles are charged a flat rate vehicle excise tax of 1200. Visit the Indiana BMV website to renew your drivers license online. DIGEST Income tax exemption for military pay.

This form must be signed in the. Beginning in 2022 military retired. Service members from another state who are stationed in Indiana are exempt from Indiana excise taxes on their vehicle when they register their vehicle in Indiana.

Military issues including residency issues filing due dates deductions credits. Exempts military pay earned by members of an active component of the armed forces of the United States from the individual income tax. Information for Military Service Members.

If the income on line 1 of Form IT-40 includes active or reserve pay you may be able to take the Military Service Deduction. Filing for an extension.

Law Enforcement And Military Usa Barrett Firearms

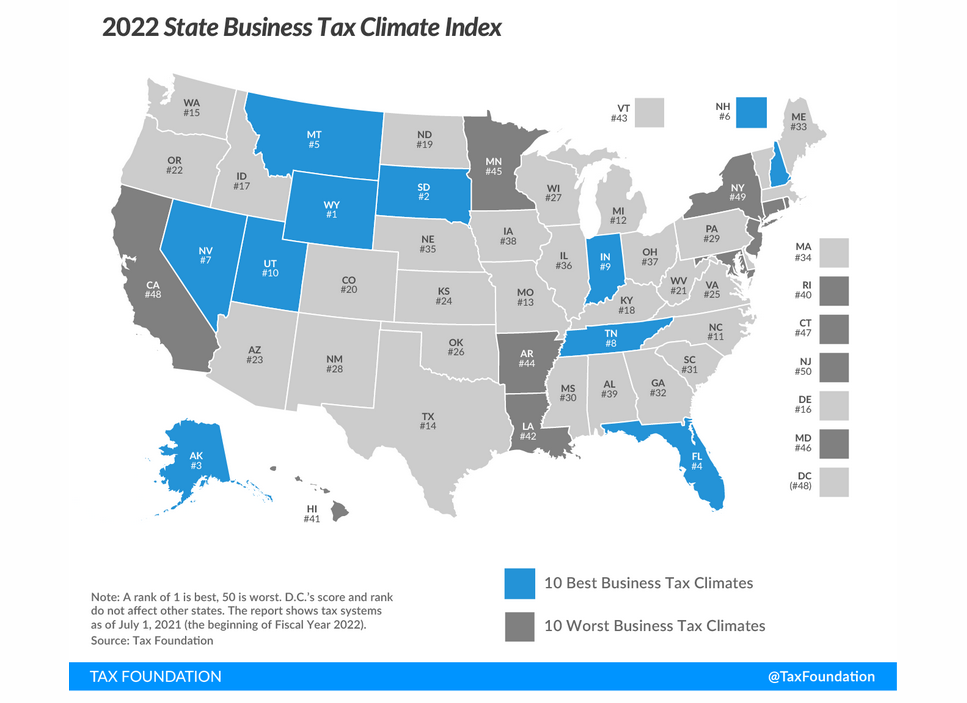

Indiana Maintains Top 10 Ranking For State Business Tax Climate Jobs And Employment Nwitimes Com

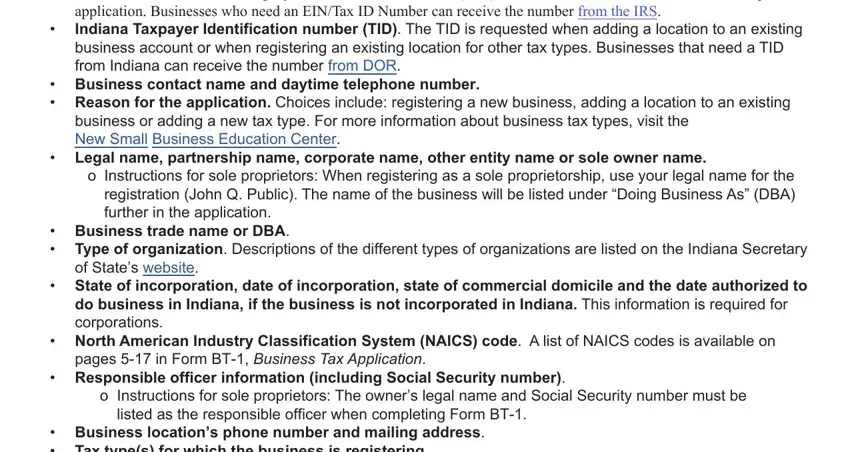

Form Bt 1 Indiana Fill Out Printable Pdf Forms Online

Indiana Military And Veterans Benefits The Official Army Benefits Website

Property Tax Exemptions Mhs Lending

State Form 46402 Download Fillable Pdf Or Fill Online Affidavit For Military Exemption From Excise Tax Indiana Templateroller

Oklahoma Business Incentives And Tax Guide Documents Ok Gov Oklahoma Digital Prairie Documents Images And Information

Top 10 Indiana Veteran Benefits Va Claims Insider

Form 1040 Ez T Request For Refund Of Federal Telephone Excise Tax

Military Retirement And State Income Tax Military Com

Indiana Department Of Veterans Affairs Ppt Download

Indiana Department Of Veterans Affairs Ppt Download

Indiana Military And Veterans Benefits An Official Air Force Benefits Website

Tax Exemption In Swat Fill Online Printable Fillable Blank Pdffiller

Kentucky Businesses Impacted By Sweeping Tax Reform

Tennessee Department Of Revenue Application For The Exemption Certificate Pdf4pro

Indiana Military And Veterans Benefits An Official Air Force Benefits Website